https://www.bitchute.com/video/5QAJfrluHCOZ

source The Ohio Assembly Land and Soil Jurisdiction

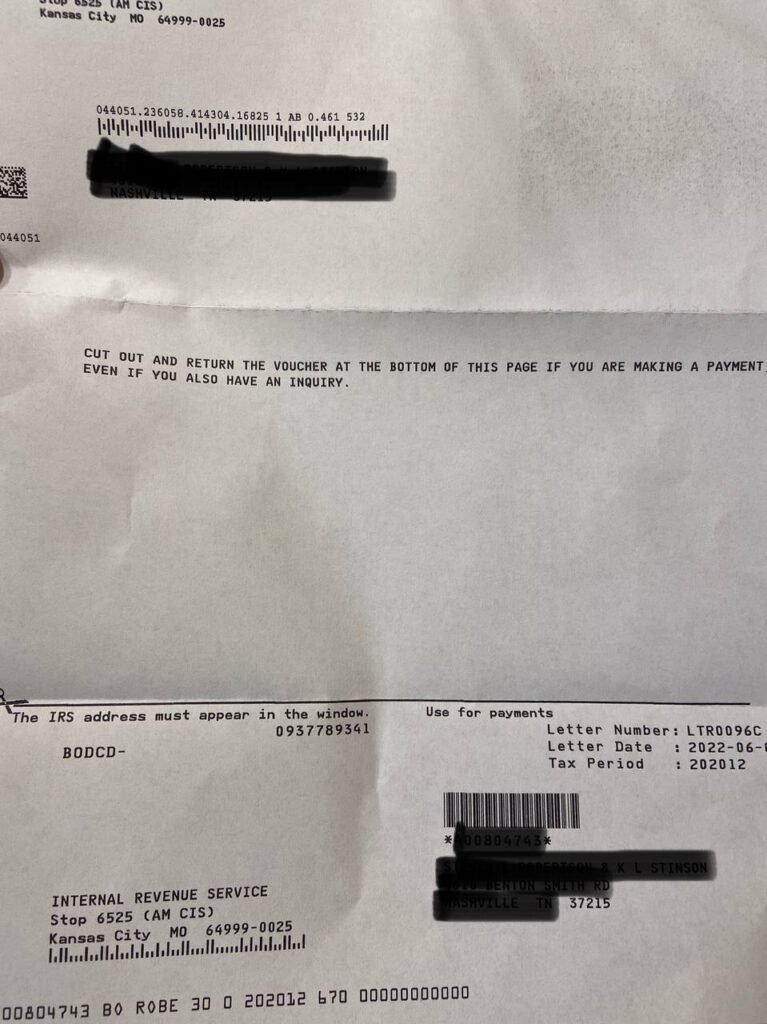

“IRS letter response:

There are templates for letters and how to complete the voucher that you

will return to them w/the cover letter example (in the text section, it’s not a template down-

load) w/your SS# w/out hyphens:

https://tasa.americanstatenationals.org/next-steps-af-

ter-sending-your-revocation-letters/

REMEMBER:

We are awaiting the IRS voucher with our SS# minus hyphens, i.e.,: 123445678

w/the voucher or any replies to IRS…1st time IRS letter response: send a ‘copy’ of your 1st

Notice letter (write or stamp ‘copy’ on it) to them & send a cover letter – follow examples on

the templates. i.e., … you are misaddressing me, I am not a taxpayer and I am enclosing my

Notice to you for the 2nd time. Make sure to type or write in blue ink on your cover letter ‘en-

closures: copy of Revocation of Election to Pay Taxes, etc.’ if you are also sending a W8 BEN,

write that on the cover letter as an enclosure. Possible example:

RE: Notice to Correct Your Records

Dear Commissioner Rettig, (or, whatever office/person sent you response)

This is my second letter to inform you that there is a mistake that has yet to be addressed. I

have revoked any agreement to pay federal income taxes since 2015 based on the fact that I

have no federal income and I am not choosing to act as enfranchised PERSONS.

Since I have received this second fraudulent notice, it looks like you have not yet corrected

my record. Please do so immediately.

Notice to Agents is Notice to Principals, Notice to Principals is Notice to Agents.

By: Jane Marie Smith©

All Rights Reserved Without Prejudice

NOTE: debtors sign on the left – Creditors sign on the right

2nd response letter they send to you: Send a ‘COPY’ of the same cover letter again, except say

for the 3rd and final time: “I am enclosing a copy, again, for the 3rd and final time. Stop mis-

addressing me.”

Consider ceasing mail delivery to your home and getting a PO box at a sub-station.

Some people are also including the W8 BEN w/their reply letter to the IRS. Anna has stated

that everything you send to the IRS is considered a ‘return’ or statement, and also, you need

to answer anything they send to you because your non-answer is considered consent and

agreement.

AGAIN: Always look for your SS# number w/out hyphens. This is what we want & it’s

a way to get this settled w/them. An example of how to complete the voucher is on

above link.”

Source The Tennessee General Assembly Agenda

Once you receive the voucher you can settle the account with the IRS and the Internal Revenue Service by filling out the voucher and returning it to them. Below is an example on how to fill out the voucher.

Coupon-for-Fear-Letter-Response“If you actually worked for the federal government the portion of your pension that is based on federal employment is taxable, but if like so many of us, you never actually worked for the federal government or only served in the military for a couple years, etc., so that the amount of pension money from actual federal employment is negligible, you are eligible to claim your exemption from federal income taxes.

You send a Letter of Revocation of Election to the Commissioners of both the IRS and the Internal Revenue Service and tell them that you revoke your election to pay federal

income taxes beginning with October the first of last year or any prior year you choose.

Internal Revenue Office of the Commissioner

Room 3000 1111 Constitution Avenue NW

Washington, DC 20204

Commissioner of the Internal Revenue Service

Department of the Treasury

P.O. Box 480 Holtsville, New York 11742

Send these Notices via Registered Mail. Make a copy (of the documents) and the mailing receipts and/or the Green Card Return Receipt Requested for your Eternally Done and Over File.”

Source https://tasa.americanstatenationals.org/revocation-of-election-to-pay-taxes/

Revocation Templates to Commissioner Rettig at 2 different addresses: